BLOGS

Identify areas for practice improvement before tax season

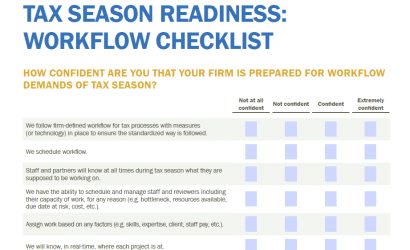

If workflow and efficiency are a top priority and you are interested in identifying areas where processes could be improved before tax season hits, now is the time to review four key steps in the tax work process.

The first step that may be improved involves how you gather documents when they stream into the practice. After documents are gathered, examining how you process the work and store files is followed by scrutinizing your method(s) of delivery. Reveal opportunities for improvement in your practice with this Gather, Process, Store and Deliver Checklist.

Gather

To achieve maximum efficiency as documents are gathered you will need to streamline and systemize how they are identified, named and filed. Forms recognition software helps in this area, as does document management software, Web portals and workflow software. The most successful firms consistently handle documents in the same systemized manner, they are not difficult to locate because they are always named and filed correctly.

Process

The second area to examine is how your firm processes tax work. This area is greatly impacted by the steps required to find and open digital documents as well as how the next in line is notified when the file is ready. Ensuring all documents supporting a client engagement are organized and at your fingertips whenever needed greatly impacts workflow and efficiency.

Digital work binders organize documents of all types and formats. Ideally, every tax document is scanned up front, other document types within work binders are kept in their native file format and documents are centrally located and accessible by multiple people simultaneously. Tools within a PDF editor such as tickmarks’, signatures and a calculator that allows a noted tape to be pasted to the work paper can simplify the process. Workflow software aids this phase of work by updating the status of the project’s progression and informing the next person in line to work on the tax file the project is ready for them.

Store

Documents you store should be secure, have a simple indexing structure and easy to retrieve. Ideally, completed tax returns and supporting documentation will be stored digitally with retention rules based on document type and independent from software applications used to create them. Documents and tax work stored as a single fully-bookmarked searchable PDF retains its integrity over time. Storing documents in this way enables quick retrieval and eases delivery. When retention rules are applied and for the purpose of further insulating your practice from risk, you should be alerted to remove documents that have reached the end of their required retention period. Digital storage, as described here, will reduce the practice’s reliance on paper storage, perhaps eliminating it.

Deliver

The final step in tax work is delivery of the tax return to the client. The ability to efficiently deliver the tax return in the way clients prefer without laboring through a time-consuming or costly delivery process is critical. When a client’s documents and tax work is stored in the way described in this article, as fully-bookmarked searchable PDF, a word search will instantly locate the document for delivery. Delivery using a Web portal or secure email is the most secure, efficient and cost-effective way to handle this task.

LEARN MORE ABOUT DOC.IT DMS AND WORKFLOW SOFTWARE! Join a webinar or contact us today.

Join a webinar: View webinars